Understanding Private Placement Memoranda (PPMs)

Private Placement Memoranda (PPMs) are crucial legal documents used to solicit investments in private companies; They detail the offering’s terms, risks, and the issuer’s financial projections, providing potential investors with essential information for informed decision-making. PPMs are legally required for private placements and ensure transparency.

What is a Private Placement Memorandum?

A Private Placement Memorandum (PPM), also known as a private offering memorandum, is a comprehensive legal document that discloses vital information to prospective investors in a private placement offering. Unlike public offerings, which are subject to strict SEC regulations and public disclosure requirements, private placements are exempt from these rules and rely heavily on the PPM to provide transparency. This document is crucial because it outlines the terms and conditions of the investment opportunity, including details about the company, the securities being offered, the risks involved, and the investment structure. The PPM serves as a legally binding contract between the issuing company and the investors, protecting both parties and ensuring compliance. A well-crafted PPM is essential for attracting investors and securing funding for private companies.

Key Components of a PPM

A comprehensive PPM typically includes several key sections. These often begin with an executive summary providing a concise overview of the investment opportunity. A detailed description of the business and its operations follows, including its history, management team, and industry landscape. Crucially, the PPM outlines the offering’s terms, specifying the type of securities offered, their price, and the total amount of capital sought. Financial statements and projections are included to showcase the company’s financial health and future prospects, offering potential investors insight into the company’s viability and return potential. Risk factors are explicitly addressed, providing a candid assessment of potential challenges and uncertainties. Finally, the PPM often concludes with legal disclaimers and other necessary information to ensure compliance with relevant regulations, protecting both the issuer and the investor.

Legal Considerations and Compliance

Creating a legally sound PPM requires careful attention to various regulations. Compliance with securities laws, such as Regulation D under the Securities Act of 1933 in the United States, is paramount. These regulations govern the permissible methods of offering and selling securities privately. The PPM must accurately reflect the company’s financial situation and future prospects, avoiding misleading or inaccurate statements. It’s essential to include appropriate disclaimers and warnings regarding the risks associated with the investment. Seeking legal counsel from a securities attorney specializing in private placements is highly recommended to ensure full compliance with all applicable laws and regulations. Failure to comply can result in significant legal penalties and damage investor trust. A well-drafted PPM significantly reduces these risks.

Obtaining a Sample Private Placement Memorandum PDF

Numerous online resources offer sample PPM PDFs, ranging from free templates to comprehensive paid packages. Reviewing these samples provides valuable insight into the structure and content of a well-drafted PPM. Always consult legal counsel for personalized advice.

Finding Free Templates Online

While comprehensive, professionally-prepared Private Placement Memoranda (PPMs) often come with a price tag, several online resources offer free sample templates. These templates can serve as valuable starting points for understanding the structure and essential components of a PPM. However, it’s crucial to remember that free templates are typically generic and may not fully reflect the specific requirements of your particular offering. They often lack the detailed legal language and nuanced risk disclosures necessary for compliance. Using a free template should be viewed as a learning tool, providing a framework to understand the organization and flow of information, rather than a complete, ready-to-use document. Always consult with legal counsel to ensure your final PPM meets all applicable regulations and adequately protects your interests.

Accessing Paid Templates and Packages

For a more comprehensive and legally sound approach, consider purchasing professional PPM templates or packages. These often include not only the core PPM document but also supplementary materials such as investor questionnaires, subscription agreements, and potentially even assistance with regulatory filings. The cost varies widely depending on the provider and the level of customization offered. While more expensive than free templates, paid options often incorporate up-to-date legal language, ensuring compliance with current regulations. They also frequently include features designed to streamline the process of creating a polished and professional document. This can save significant time and effort, allowing you to focus on the substantive aspects of your offering. Remember to carefully review the provider’s reputation and the specific features included before making a purchase.

Reviewing Sample PPMs from Law Firms

Many law firms specializing in securities law offer sample Private Placement Memoranda (PPMs) on their websites or through other channels. While these samples may not be fully customizable templates, they provide invaluable insights into the structure, language, and required disclosures of a compliant PPM. Reviewing these samples allows you to familiarize yourself with the professional standards and legal requirements for such documents. By observing how experienced legal professionals present complex information clearly and concisely, you can improve your understanding of best practices. Note that these samples are usually for illustrative purposes only and should not be used as direct templates without legal consultation. Always seek professional legal counsel to ensure your PPM fully complies with all applicable regulations and protects your interests.

Creating Your Own PPM

Crafting a compliant PPM requires meticulous attention to detail and legal expertise. Using a template as a guide is advisable, but professional legal counsel is essential to ensure accuracy and compliance with all applicable regulations.

Using a Template as a Starting Point

Leveraging a sample Private Placement Memorandum (PPM) template offers a significant advantage when creating your own document. These templates provide a structured framework, outlining the essential sections and formatting conventions required for a compliant PPM. By utilizing a template, you can streamline the creation process, saving valuable time and effort. However, it’s crucial to remember that a template is merely a starting point. Directly copying a sample PPM without customization is not advisable. A successful PPM reflects the unique specifics of your company and offering, demanding careful adaptation to incorporate your business details and financial projections. Remember, a generic template will not suffice; your PPM must accurately represent your particular circumstances.

Essential Information to Include

A comprehensive Private Placement Memorandum (PPM) necessitates the inclusion of several key elements. Crucially, it must clearly articulate the offering’s purpose, specifying the amount of capital sought and its intended use. Detailed descriptions of the company’s operations, business model, and market position are also essential. Financial projections, including revenue forecasts and expense budgets, should be presented transparently. The PPM must also disclose all material risks associated with the investment, offering a realistic assessment of potential challenges. Furthermore, it should clearly define the terms of the investment, including the type of securities offered, the investor’s rights, and the exit strategy. Finally, the PPM must comply with all applicable securities regulations and include any necessary legal disclaimers.

Seeking Legal Counsel

Given the complexities and legal ramifications of creating a Private Placement Memorandum (PPM), seeking legal counsel is not merely advisable but essential. A seasoned securities attorney possesses the expertise to ensure the PPM’s compliance with all relevant federal and state securities laws, mitigating potential legal risks. They can guide you through the intricacies of Regulation D, helping to determine the most suitable offering structure and ensuring the document’s accuracy and completeness. Legal counsel can also assist in crafting clear and unambiguous language, minimizing the potential for misinterpretations by investors. Their involvement ensures the PPM effectively protects the interests of both the company and investors, while avoiding potential legal challenges and liabilities. This professional guidance is invaluable in creating a legally sound and investor-friendly document.

Dissecting a Sample PPM

Analyzing sample PPMs offers invaluable insights into structure, format, risk disclosures, and financial projections, facilitating a deeper understanding of these critical investment documents.

Analyzing the Structure and Format

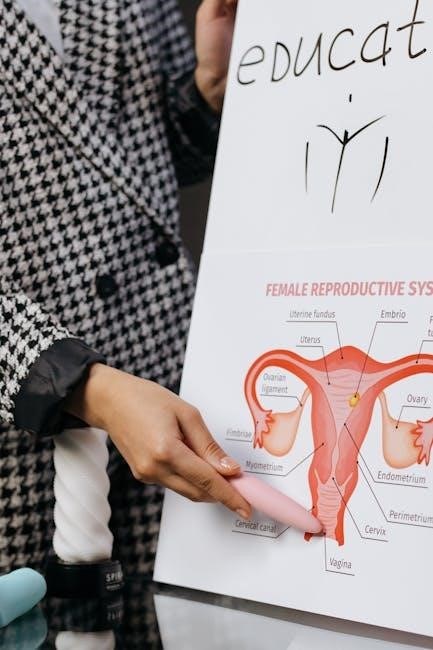

A thorough examination of a sample Private Placement Memorandum (PPM) should begin with a careful review of its structure and format. Understanding the logical flow of information is crucial. Look for a clear and concise executive summary upfront, followed by sections dedicated to the company’s business description, offering details (including the type of securities offered and the amount of capital being raised), financial projections, risk factors, and the use of proceeds. The use of tables, charts, and other visual aids can greatly enhance readability and comprehension. Note how the document presents complex financial data, ensuring it’s accessible to investors with varying levels of financial expertise. Pay attention to the overall organization; is it easy to navigate and find specific information? Does the document’s format contribute to or detract from its clarity and professionalism? A well-structured PPM demonstrates professionalism and facilitates a smooth understanding of the investment opportunity. A poorly structured document, however, may raise concerns about the company’s attention to detail and overall competence.

Understanding Risk Disclosures

A critical aspect of analyzing a sample Private Placement Memorandum (PPM) involves a meticulous review of its risk disclosures. This section is paramount, as it outlines the potential downsides and challenges associated with the investment. Look for a comprehensive and transparent presentation of all material risks, including financial risks (e.g., potential losses, illiquidity), operational risks (e.g., management changes, competition), and legal risks (e.g., regulatory changes, litigation). The language used should be clear and understandable, avoiding overly technical jargon. The specificity of the risks described is also important; vague or generic statements are insufficient. Assess whether the disclosed risks are appropriately categorized and prioritized. A robust risk disclosure section is not just a legal requirement; it also demonstrates a company’s commitment to transparency and investor protection. The effectiveness of the risk disclosures significantly influences an investor’s perception of the investment’s suitability and overall attractiveness.

Interpreting Financial Projections

Financial projections within a sample Private Placement Memorandum (PPM) are forward-looking statements estimating future financial performance. Scrutinize these projections carefully, understanding they are not guarantees. Assess the underlying assumptions used to create the projections; are they realistic and supported by market data and industry trends? Pay close attention to key metrics like revenue growth, profitability, and cash flow; Compare the projected figures to the company’s historical performance; do the projections show a reasonable and achievable trajectory? Look for sensitivity analyses that illustrate how changes in key assumptions might impact the results. Consider the qualifications and experience of the individuals responsible for creating the projections. Are they independent and objective, or are there potential conflicts of interest? Remember, financial projections are just one piece of the puzzle; use them in conjunction with other information in the PPM to form a holistic view of the investment opportunity. A thorough understanding of the financial projections is crucial for making an informed investment decision.

Leave a Reply

You must be logged in to post a comment.